Indicative Course Content

Financial Sector: Hicks-Hansen (IS/LM ) function, Product Money Equilibrium, Money

Market Equilibrium, General Equilibrium of Product and Money Market, Changes in

General Equilibrium Definition and Function of Money; Evolution of Money.

Financial Markets: Nature and Functions of Financial Markets, Money Market, Capital

Market, Distinction between Money Markets and Capital Markets, Inter-relationship

between Money Markets and Capital Markets. Primary markets and Secondary

markets. Money Market Instruments: Call money, Treasury Bills (TB), Commercial

paper (CP), Certificates of deposits (CD), Participation certificates (PC), Repo

Transactions.

Organization and Functions of Securities Market: Securities markets, Primary

markets, Secondary Markets, Capital markets and Money Markets, Currency Markets

Mortgages and Mortgage Markets: Mortgage-backed Securities, Collateralized

Mortgage Obligations

Regulatory Mechanism: Primary markets and secondary markets operations,

Trading mechanism, Settlement systems, Indices, Terminology, Investor

Protection.

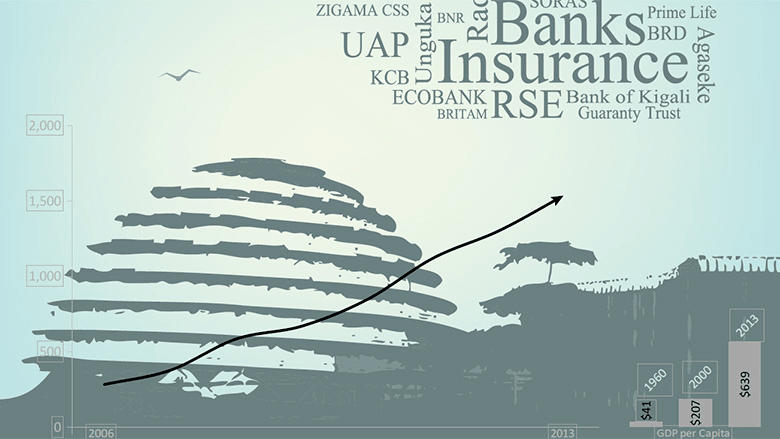

Capital Market in Rwanda: Rationale for capital markets in Rwanda; Investment

alternatives Legal and regulatory framework, Functions of capital market authority,

Operations of Rwanda Securities Exchange; Floatation on securities on stock

exchange; Role of capital markets in national economy.

Financial Intermediaries: Meaning, Financial Intermediation, Process of

intermediation, Role of Financial Intermediaries, Financial Intermediation in Savings

and Investment Process.

Non-Bank Financial Intermediaries (NBFIs): Meaning, Role and functions, NBFIs and

Monetary Policy, Distinction between Banks and NBFIs.

Development Banks: Concept of Development banks, Types of Development Banks,

(Regional Banks and World Bank Group), Role in development.

- Module Team: Dr. Bhupendra Kumar